5 Reasons to Buy Now in the Treasure Valley

Home buyers are increasingly finding that home prices are on the rise in many markets. Boise is no exception. A lot of buyers were waiting for the bottom of the market to buy so they could get the best deal possible. Nobody was really certain of when that was going to be though. Then there are those buyers now who have just started thinking about purchasing because maybe they are tired or renting, finally saved up enough money for a down payment, or got their credit issues fixed. Either way, the local housing market is picking up and I think the best deals are behind us. However, if you were thinking about buying a home, but were unsure of the housing market, then here are some signs that should ease those fears about whether now is the time to get your foot in the door.

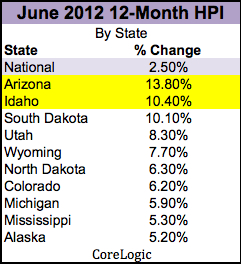

1. House prices are on the rise. This graph provided by CoreLogic shows that Idaho ranks #2 in the nation for the last year-over-year home price increases (HPI) across the country.

2. Inventories of for sale homes on the market are decreasing. In fact, inventories of for sale homes have dropped 24% from a year ago. There is more demand now than there is supply. This wasn’t an issue a year ago. About 50% of last years sales in Ada County were distressed sales (bank owned or short sales). With a lot of those deals gone it has left buyers fighting over the same houses causing multiple offer situations that put sellers in the drivers seat. One good thing about this is that when supply dries up builders start building new houses again. This creates more jobs and is better for the overall local economy.

3. Mortgage rates are at record lows. This has helped make housing much more affordable, especially for first time buyers. The average 30-year fixed mortgage rate is 3.59% according to Freddie Mac, just above the record low set on July 26th of 3.49% average.

4. Mortgage payments are cheaper than rent payments. With record low interest rates to help it is now cheaper to buy a home than it is to rent a home or apartment. I am not just saying this. I have actually seen some of my clients’ monthly mortgage payments be less than their current monthly rent. In fact, a recent study found that it is cheaper to buy a home than it is to rent in basically every major city in the U.S. For those who buy, you can save the cost of renting by owning the home for five years or less. Rents have been on the rise the last few years and are predicted to continue to rise. This is great for investors and landlords, but where does that leave the many others? Many will pay the investors’ mortgages while they could be paying themselves equity for future gain.

5. Affordability is still at a record high. Even though housing prices have increased and foreclosures have slowed there are still bargains to be had. The median single family home price hit its lowest in more than a decade when it reached $154,600 in January according to the National Association of Realtors. That was the lowest since October 2001. During the peak of the housing market in July 2006, the median home price for a single family home was $230,900. This is a national stat, but I think Ada County’s median home price was very similar. I still see good deals coming on the market daily in all areas of the valley. Buyers just have to be prepared and jump on them right away.